MAP’s 2025F M&A Market Outlook: (As of Q3 2025)

How’s the market? Here’s our 2025F M&A Market Outlook: (as of Q3 2025)

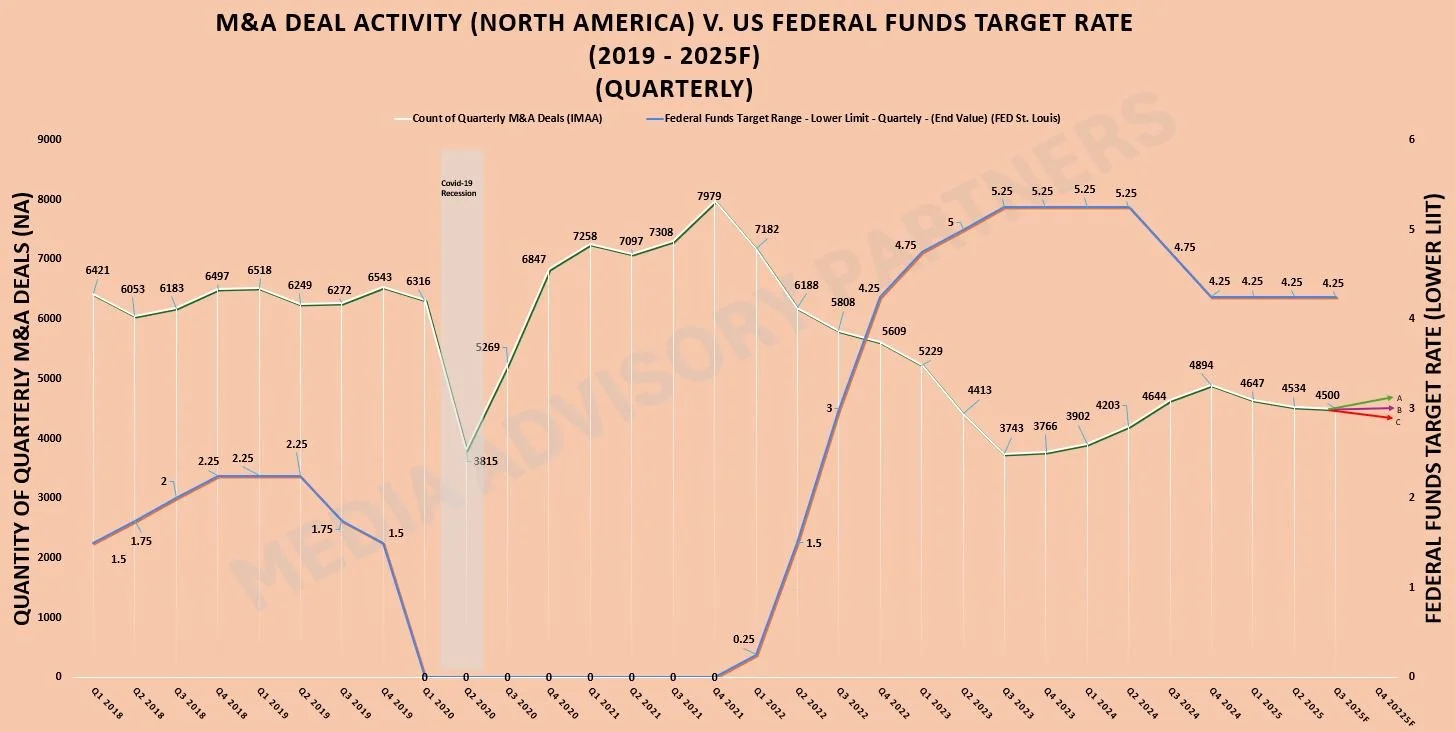

Last quarter, Media Advisory Partners (“MAP”) correctly forecasted (to within 2% of actuals) that 4,450 total M&A transactions would take place in Q2 2025. MAP is now forecasting 4,500 completed transactions in Q3 2025 (in North America).

There’s some momentum heading into Q3 2025. In the last quarter (Q2 2025), M&A deal volumes in North America increased by 8% year-over-year. Year-to-date M&A volumes increased 13.3% as of June 2025.

Leading research projects resilient growth in M&A deal volumes for 2025: “PwC expects M&A activity to improve in the coming quarters, with pressure from the LP funds looking for returns and as assets are repriced.” According to Goldman Sachs Research, the probability of a Fed rate cut in September is “somewhat above 50%.” Lower interest rates reduce the cost of borrowing for acquirers, which boosts acquisition returns and makes deals more attractive.

OUR 2025 M&A OUTLOOK (for Q4 2025):

⬆️ 2025 SCENARIO A (bullish): Interest Rate Cut(s) + Geopolitical Stabilization = Increased M&A Deal Volumes (~4,650+ deals per quarter on average)

➡️ 2025 SCENARIO B (flatline): No 2025 Interest Rate Cut + Continued Geopolitical Instability = Potential M&A Deal Volume Plateau (~4,550 deals per quarter on average)

⬇️ 2025 SCENARIO C (bearish): Resurgent Inflation + Pronounced Geopolitical Instability = M&A Deal Volume Declines (~4,450 or less deals per quarter on average)